Applying A Valuation To Sirius XM

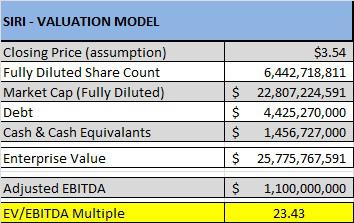

With Sirius XM's (SIRI) recently added debt, the rise in the stock price, and the shrinking of the share count via a share buyback program, it is perhaps a good time to explore the current valuation of Sirius XM. While there are many ways to value a company I like to use the EV/EBITDA method because Sirius XM is a media company and media companies tend to be valued on their EBITDA growth and free cash flow growth.

The EV/EBITDA method is obtained by taking the Enterprise value and dividing it by EBITDA. Enterprise Value is the Market Cap + Debt - Cash. EBITDA is the earnings before interest, taxes, depreciation, and amortization. Historically, Sirius XM has traded at a multiple of between 17 (on the low side) and 24 (on the high side). As the components of the formula change, the multiple will change as well. Usually the component that moves is simply the share price. Debt issues arise from time to time, and share count can change from time to time.

Recently we have seen all facets of Enterprise Value change. The company added a $1.25 billion dollar credit facility, had two $500 million dollar debt issues (total of $1 billion), has bought back 209 million shares, and of course, the price of the equity changes daily. With all of these moving parts, assessing an exact valuation is difficult. For the time being, the company will not be issuing more debt, so one moving part has settled down. The company will continue with share buybacks, but we do not know the rate at which these are happening. Simply stated, we need to make some assumptions.

This brings us to the concept of outlining the components of obtaining an EV/EBITDA valuation.

- We use the current share price and the share count in the last company filing to obtain the market cap.

- I count the credit facility as if it has been drawn upon. This adds $1.25 billion to the cash column as well as the debt column.

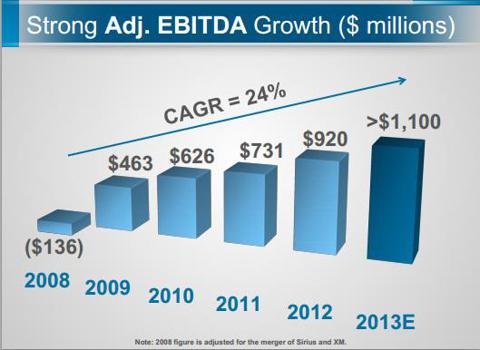

- I use current company EBITDA guidance of $1.1 billion. When the company updates this guidance for next year, the EBITDA assumption can be adjusted. If you are interested in looking at a longer term with other assumptions, simply assume 2014 EBITDA at about 28% growth. This would make the assumption for next year at $1.4 billion.

In my model you will see that the current multiple sits at about 22.91. That is at the high end of the multiple range that Sirius XM typically traded in. The high level multiple of 24 would be attained if the equity gets to $3.73. This is a few cents away from my "reasonable" target for the year. My high end target (a level the equity may touch and retreat from) is $4.25.

Heading into the doldrums of summer, we may see this equity reach impressive levels on the fact that the company, via share buybacks, is supporting the price of the stock. I anticipate that the company will go well beyond the $2 billion that it committed to buybacks and this support dynamic will continue to exist. In fact, I believe that once Liberty Media (LMCA) begins to participate in these buybacks that the news will be more publicly known, as Liberty Media would want to sell its shares at as high a price as possible.

While share buybacks are happening, I believe that there is a distinct possibility that this company can touch EV/EBITDA multiple of 27 under the right conditions. Further, as 2012 passes, and it becomes clear that Sirius XM is hitting EBITDA targets, the market will begin to make assumptions regarding future EBITDA and thus allow a higher valuation.

Simply stated, there is justification for the current trading levels based on the historical multiples that this equity has traded at. There is justification for appreciation from here due to strong company performance and a better macro-economic environment. Lastly, the share buyback dynamic is yet another justification for a higher valuation.

I see Sirius XM as a buy on virtually any dip. I think the realistic price goal is currently about $3.75 with spikes to $4.25. Big news, such as an announced increase in the share buyback program can move this even further. As the quarters of 2012 pass and current guidance seems more and more real, the confidence of trading at, and maintaining, higher multiples will become easier for the street to digest. Stay Tuned.

No comments:

Post a Comment