Priceline Leads Online Travel, An Increasingly Competitive Space

Priceline (PCLN) is one of America's great companies and success stories. It is a very popular online service that helps consumers shop for travel arrangements, and, in turn, for transportation and hospitality businesses to reach their clients. The corporation and its stock are known for generating wealth in recent years, closing today at $724.77, a decade after trading below $10 per share in 2003. As a winner, it may be associated with Apple (AAPL), AutoZone (AZO), or Google (GOOG). While it might be ironic that two out of three of those names also pose increasing threats to Priceline's future prospects, I am in agreement with two of the largest and most respected financial institutions that the company should be viewed favorably by investors.

Here is the ten year chart for PCLN, showing how the stock has performed:

A Barron's article is not optimistic, and cites increasing competition as a concern. It may be considered alongside Deutsche Bank's most recent research note reiterating a Hold rating placed on PCLN since 12/10/12, and providing a price target of $745. Expedia (EXPE) is Priceline's rival, with pressure exerted by TripAdvisor (TRIP), and Orbitz Worldwide(OWW). Concern about Google is widespread. Barron's also adds that:

Wall Street's sanguine expectations mean that the disappointment could be severe if margins slip.

Sure enough, Jim Cramer and his staff at The Street like Priceline. For this article, the research of three highly regarded European firms, that all are also identified with Wall Street, is being utilized to assess the company's investment potential. UBS and Credit Suisse recommend the stock, clearly favoring it to Expedia; and Deutsche Bank's methodology and insight is quite helpful.

UBS (April 1, 2013)

UBS has initiated coverage with an $825 price target and a Buy rating. In sum, it says the company's

Strengths include a strong intent to purchase travel on the part of Priceline's visitors and a reputation as one of the original disruptors of the traditional travel agency model. Offsetting this are increasing competitive pressures in the form of increased marketing spend to drive bookings…In particular, we expect the combination of the Booking.com and Agoda.com to outperform Expedia and the overall global online travel market…Over the next twelve months, we are more biased to the upside.

Priceline operates primarily through four global brands, all of which UBS views favorably:

- Priceline.com - Website known for its Name Your Own Price to North American leisure travelers.

- Booking.com - Global online hotel reservation service.

- Agoda.com - Hotel reservation service primarily focused in Asia-Pacific.

- Rentalcars.com - Global car rental service.

According to UBS,

The bull case around the OTAs (Online Travel Agents) is that they only comprise a mid-single digit percentage of hotel room nights sold on a global basis at present, and therefore there is a multiple year growth trajectory ahead for those businesses. Broadly, we agree...

UBS views the situation through a prism of Margins v. Investment, as Priceline "…Re-deploy(s) margin improvements into driving brand loyalty and more direct site traffic…significant acquisitions to increase international footprint have been made."

UBS is clear, and makes a compelling case that Priceline is a top operation and preferred over Expedia.

Despite the recent efforts of Expedia, on a pure operating basis, we expect the combination of the Booking.com and Agoda.com assets to outperform Expedia and the overall global online travel market from the period of 2012-2017… By 2015, we expect that Expedia will have EBITDA margins of 21.2% and FCF conversion of revenue of 16.3% (increases of 130bps and 80bps from our expected 2013 levels, respectively). During that same time period, we expect that Priceline will have EBITDA margins of 38.8% and FCF conversion of revenue of 31.4% (increases of 140bps and 100bps from 2013 levels, respectively). Also, Priceline lacks exposure to air travel (~2% of revenues) and organized corporate travel, businesses that impact the consolidated margins at Expedia.

Lower exposure to air transport is currently good. UBS adds that

the airline industry has recently become more disciplined in terms of capacity levels, resulting in an uptick for both occupancy and pricing levels…Additionally, given airlines tend to pay a flat fee to the OTAs (while hotels generally pay a percentage of the product price)…OTAs are not able to easily offset the lower airline seating capacity with benefits from improved pricing.

Credit Suisse (April 25, 2013)

Credit Suisse has an $886 Price Target and an Outperform rating. Its research note says,

We continue to believe PCLN shares are reflecting a scenario in which it will suffer online advertising deleverage and operating margin compression without giving the management team credit for finding ROI against what equates to an incremental $500+ million in online advertising spend between 2012/2013.

Paraphrasing Priceline's 10-K (17 of 160), it refers to this issue and risk factor:

Priceline has a need to maintain or enhance consumer awareness and acceptance of brands, and even if successful, it may not be cost-effective. There has been a significant increase in online advertising expense through recent years, which is expected to continue. Online advertising ROIs are down YoY.

Credit Suisse expects an increase from 275,000 properties at the time of its 4Q12 earnings, to over 300,000 properties when it reports:

Suggesting about 44.3% year-over-year growth in inventory… Also, the hotel room night mix is expected to shift away from Europe as our checks also suggest that Agoda.com grew its inventory in the AsiaPac region by 60%+…We have modeled Agoda to grow Gross Travel Bookings by ~45% ex-FX in 1Q13…Among dangers to Priceline's achievement of its $886 target: (1) economic uncertainty: any downturn in consumer sentiment could adversely affect travel bookings; (2) competition: Priceline is subject to intense competition...

Deutsche Bank (4/18/13)

Deutsche bank has had a Hold rating on the stock since 12/10/12, and currently has a $745 price target. Perhaps most pertinent for an options trade:

We expect Priceline to report upside to 1Q consensus and guide conservatively for 2Q13, as usual, the key question comes down to magnitude as buyside expectations are above consensus, and the recent upside has been below average…we expect similar ~300bps margin compression in the guidance, and then start to improve in late 2013 based on management's comments. Overall demand trends [occupancy and Average Daily Rates (ADRs)] in Europe largely remain unchanged from prior quarters, despite some of the macro grumblings following the Cyprus events and currency fluctuations.

The German firm bases its neutral thesis on:

1) Increasing competition from Expedia following its re-platforming,

2) Lower ROI from desktop search, and

3) Google's eventual aggressive move into the space…Google's increasing Hotel Finder push in Europe should be largely benign to financials but could impact sentiment.

The note also says that "Key risks include a slowdown in international travel, currency fluctuations and ADR declines." It is revising down estimates for total 2014 bookings -1% with a -.9% hit to gross margins.

For the clarity and ease of presentation, and also methodology that is agreeable, I currently favor Deutsche Bank's calculations. The firm uses an average of Implied Stock Prices based on (1) forward Adjusted EPS, $791; (2) forward Adjusted EBITDA, $711; and (3) forward FCF, $713 to calculate a 2013 $745 target price. For the purposes of valuing a stock, my preference is to use the following year's figures, and Deutsche Bank's forward estimates based on EPS is $917, on EBITDA is $849, and on FCF is $822. The result of averaging the three, which Deutsche Bank does not do for 2014, is $867.22. Data to produce price targets using the German firm's methods follows:

UBS's figures are:

- $2.44B 2014 FCF estimate, using 51M shares, $47.84/share (its uses a 13x EV/Cash Flow multiple).

- $2.97B 2014 EV estimate, their EV/EBITDA multiple is 12x.

- $47.82 2014 EPS, their multiple is 14.4.

Credit Suisse's figures:

- $2.207B 2014 FCF estimate, using 51M shares, we get $43.28 per share.

- $3.022B 2014 EV estimate, their EV/EBITDA multiple is N/A.

- $42.42 2014 adjusted EPS, their multiple is 16.5.

For the purpose of calculating a consensus, I am using an estimated 51M share count. This allows for the possibility of small buybacks, which is discussed in greater depth later. Without repurchasing, the number of shares outstanding is likely to be closer to 52M. All three firms use different tactics to arrive at their price targets. I am applying their data to part of Deutsche Bank's methodology in order to provide a 2014 consensus using an average of implied stock prices based on each's 2014E FCF and also EPS. This procedure deviates from firms' methods, which in turn are unique to each other. For example, it does not include Credit Suisse's Discounted Cash Flows and 2018E Terminal Value, or UBS's emphasis on Enterprise Value.

Forward Estimates

|

UBS

|

Credit Suisse

|

Deutsche Bank

|

2014 Free Cash Flow per Share

|

$47.84 (5.21% Yield)*

|

$43.28 (5.21% Yield)*

|

$45.23 (5.5% Target Yield)

|

2014 Earnings Per Share

|

$47.82 (14.4x)

|

$42.42 (16.5x)

|

$45.83 (20x)

|

2014 Target

|

($918.23+$688.61)/2 = $803.42

|

($830.71+699.93)/2 =$765.32

|

($917+$822)/2 = $869.50

|

Firm's Actual Target

|

$825 (12 months)

|

$886 (12 months)

|

$867.22 (applying 2014 estimates to 2013 methods)

|

Consensus (2014 Calculated Targets / Actual Target price)

|

$812.75 / $859.41

| ||

Sources: Current research notes for April, 2013. *yield calculation extrapolated and based on 5/3/13 closing share price of $724.77 and firm's 2013E FCF

| |||

I am comfortable using $812.75 as a 12 month price target for Priceline in consideration of these three banks' data and estimates. There is 12% upside from the current $724.77 price, and it is likely conservative, as it is lower than each of their actual projections. As much can happen in the course of a year, closer examination of fundamentals is needed. Further, confidence pertaining to Priceline's future margins is lacking. Apple needs results, having guided lightly. I think it could be nearly as formidable an entrant as Google.

Search engine algorithm changes could negatively impact Priceline's relative appearance in results, potentially decreasing traffic to sites and resulting revenue. Additionally, increased competition for key words could drive pay-per-click pricing higher, leading to higher traffic acquisition costs. Priceline obtains "Significant revenue through pay-per-click advertising campaigns on Internet search engines…(p. 23 of 160)." Google has launched a flight search tool that excludes OTAs within search results (p. 16 of 160). Current and potential competitors may be able to leverage search or mobile device businesses (p. 15 of 160). Apple, for example, has a new patent for "iTravel," a mobile app allowing a traveler to check in for a reservation, and offers "Passbook," a virtual wallet app that holds tickets, passes, and gift cards (Source: Priceline 10-K).

Also, some suppliers may offer exclusive product offerings and rewards programs at the supplier-owned sites only, which could make direct booking a more attractive option to traveler customers. One example of this threat is Room Key, an online hotel reservation service intended product launched by Choice Hotels International (CHH), Hilton Worldwide, Hyatt (H), InterContinental Hotels Group (IHG),Wyndham Hotel Group (WYN), Marriott (MAR), La Quinta andMillennium, to drive consumers directly to the merchants' own web sites (10-K 16 of 160).

However, UBS

Believe(s) Priceline presents a compelling risk/reward at current valuations given [its] above industry growth forecasts and the potential for cash returns to shareholders (e.g., buybacks) following the close of the pending Kayak acquisition.

It is the only one of the three firms to explore the possibility of capital returns, and specifically repurchasing, in its most recent research note. In November, 2012, Priceline spent $1.3B in common stock and $500M in cash to acquire Kayak, and the deal is expected to close during the first half of 2013 (10-K 45 of 160). For its "Upside case scenario," UBS projects $2B in buybacks changing the outstanding share count from 51M to 48M in 2014. A review of Priceline's past share repurchase activity leads me to believe that this is optimistic.

As of December 31, 2012, we had remaining authorizations from our Board of Directors to repurchase $459.2 million of our common stock. We may from time to time make additional repurchases of our common stock, depending on prevailing market conditions, alternate uses of capital, and other factors (10-K 62 of 160).

Here is a table showing pertinent data in recent years:

Priceline Stockholders' Equity & Share Repurchase Data

(Numbers in 1,000s)

| ||||

2009

|

2010

|

2011

|

2012

| |

Treasury Stock Balance (Dec. 31)

|

(6,865)

|

(7,241)

|

(7,780)

|

(8,185)

|

Common Stock Balance (Dec. 31)

|

52,446

|

56,567

|

57,579

|

58,056

|

Stock-based Compensation and Payments

|

N/A

|

68,396

|

66,194

|

72,035

|

Repurchase of Common Stock

|

N/A

|

(129,445)

|

(163,171)

|

(257,021)

|

Source: Priceline 2012 10-K pp (81-2 of 160)

| ||||

Let me remark that UBS recently released a statement saying that a significant return of cash to shareholders could result in Apple's share price increasing 10%. The company's share price has increased from the high $390 range to over $440 after announcing a record buyback during its Report. UBS could be accurate again, it just does not seem to be widely held position.

Also, per the 10-K (41 - 42 of 160), Priceline:

Experienced strong year-over-year growth in recent years, though that growth has generally decelerated. For example, in the fourth quarter of 2012, our hotel room night growth was 38%, a substantial deceleration from 53% in the fourth quarter of 2011…We expect the long term deceleration trend to continue, and we therefore expect to experience further deceleration in growth rates in the first quarter of 2013 and beyond.

Priceline is reporting First Quarter, 2013 earnings on Thursday, May 9th. Anyone who has read my articles knows that I like to consider option trades to take advantage of similar events. It is worth the time to describe what may be a terrific volatility skew, alongside a long term investment opportunity.

For the immediate future, I am inclined to adopt Deutsche Bank's view calling for strong earnings and conservative guidance. However, in agreement with UBS and Credit Suisse, competition from Expedia is probably exaggerated. Further, Google's and Apple's entry into the industry is more relevant to results in 2014 and after. Any buyback announcement is not forecast until after completion of the Kayak acquisition. Thus, the share price can increase dramatically because of earnings and guidance, though review on Friday and over the weekend is likely to proceed that type of buying. For shareholders, margin issues may be the foremost immediate concern, though Credit Suisse offers comfort.

A May 10, 2013 weekly option can be sold. The most time value can be obtained for it on Monday. However, an increase in implied volatility ("IV") throughout the week may lead to a higher price in following days; though the price for May 18 weeklies can increase also. Records show IV spiking above 50% at this time last year, and it is currently at 35.96%. Priceline does not report until after the close on Thursday, so the real worry is that the option is not assigned on Friday before it expires. With this in mind, the share price can change throughout the week, and I am inclined to sell an option that is far enough out of the money on Monday to lower the risk.

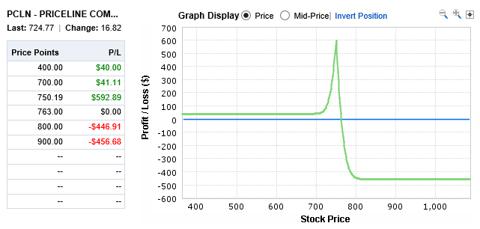

A May 10 $750 call should bring in $13.70 and a May 18 $755 is slightly cheaper at $13.30. The options show wide spreads, so liquidity and execution could be issues. However, if a trade goes through at the specified prices, then a $40 credit would be the minimum profit in all scenarios, except a rise in share price above $750.19. Seeking Alpha lists the 52 week high at $752.46, and a price above $750 at the conclusion of next week would be surprising. Here is a table and graphic showing projected profit and loss at close on Friday the 10th. Profit projections may be high, though a 20% IV collapse is assumed. However, chances are the $755 call can be kept for the beginning of the following week to watch for the stock to rise above the strike price, or sold. The maximum loss shown is -$456, almost $200 below the share price.

Priceline offers plenty to investors. Prospects for long term, international growth are obvious, though so is the competition. There is also the potential to rapidly earn profits through an options trade, which can be a lucrative and low risk course of action.

No comments:

Post a Comment