Bullish On Financials: Is The Big Bank Pullback Done?

I am cautiously bullish on the overall market, but anticipate more of a stock-pickers' environment going forward with pockets of strength and weakness. I am adding exposure to the financial sector and expect it to be one of those pockets of strength, or at least, a good place to hide for the next few months. The big banks, which represent a large portion of the Financial Select Sector SPDR Fund (XLF), pulled back over the last few weeks and are trading at key levels. It will be important to see if the big banks can stay in their multi-month uptrends and continue to lead the sector. In this article I will analyze the XLF ETF and take a closer look at the top 25 companies that comprise 70% of the value of the XLF ETF. The financials may not repeat the strong performance from last year, but look poised for further gains.

Macro Outlook

Please see my latest macro outlook and why I expect a stock-pickers market over the next few months: Still Cautiously Bullish On S&P 500 As The Stock Pickers' Market May Return. If my macro outlook changes, my perspective on the financial sector may change as well.

Catalysts And Investment Thesis

It was a lot easier to be bullish on the financials last summer. Some of the big banks were trading at wide discounts to tangible book value. Jamie Dimon called the shares of JPMorgan (JPM) a "no-brainer" buy and he was right. Since then the sector performed well and in early 2013 the XLF ETF took out the post-crisis highs.

Regarding the banks, which comprise a large percentage of the XLF ETF, there were three big catalysts last year that are, mostly, played out: the mortgage business, wide discounts to book value and the 2013 stress tests and CCAR process that determined how much capital could be returned to shareholders.

Interestingly, many of the big banks pulled back when the stress tests and CCAR results came out. The outcomes were not bad, so it was likely a "buy the rumor, sell the news" phenomenon.

The catalysts for the financial sector, especially the big banks, were more potent last year and resulted in large share price gains. The current catalysts may not lead to such large gains, but I still expect upside for the sector. The following are some upcoming catalysts for the financials, especially the banks. These catalysts are not immediate, so they could also be described as the tailwinds or the investment thesis for the sector.

The U.S. economy will probably expand in the 2-3% range this year. Economic expansion is a tailwind for the financial sector, but low growth and low leverage mean that the impact will be less than in the pre-crisis era.

The banks still face regulatory uncertainty, which is a drag on their earnings power and the amount of capital they distribute to shareholders. In 2013, many of the banks are using capital to meet the new Basel III requirements instead of distributing it. The Basel III rules, as well as the stress test requirements, are not completely clear, so the big banks seem to want to err on the side of caution and build their capital bases sooner rather than later. This is good for the financial system as a whole, but not for shareholders of individual financial institutions.

The good news, and potential catalyst, is that in 2014 the banks will be in a better position to distribute more capital to shareholders. Unfortunately, this is a few months away and it may still be too early to invest in the financials for this catalyst. At worst, it probably provides downside protection. More broadly many of the financial institutions are still undergoing restructurings, which are internal catalysts.

Some may not consider low valuation a catalyst. However, I think it can be a catalyst, especially for the banks that are trading at discounts to tangible book value. The discounts have narrowed since last year, but still serve as catalysts in some cases.

Finally, the financials seem to be under-owned. Before the financial crisis many of the financials, especially the big banks, were core portfolio holdings for many investors. The crisis changed the perception of the sector. As we move further away from the crisis, I expect there to be more interest in the financials, especially from yield-hungry investors.

It is important to note that there are many risks with the financials. It is impossible to fully analyze their balance sheets and there is always the risk of another London Whale incident at any institution. If the economy is weaker than expected all the financials would likely suffer.

XLF Performance

The XLF ETF broke out to new post-crisis highs in early 2013. Although it pulled-back recently, it is still in a multi-month uptrend.

(Source: FreeStockCharts.com)

I expect the uptrend to continue, but I am watching two downside price levels. Over the last few months $17.75 was support and then became resistance. It is important that the XLF stays above this level for short-term oriented traders/investors. If the XLF loses that level, the next big support would be in the $17.25 range. If the price action of the XLF ETF is weaker than I expect I may adjust my portfolio positions.

Breakdown Of The XLF ETF

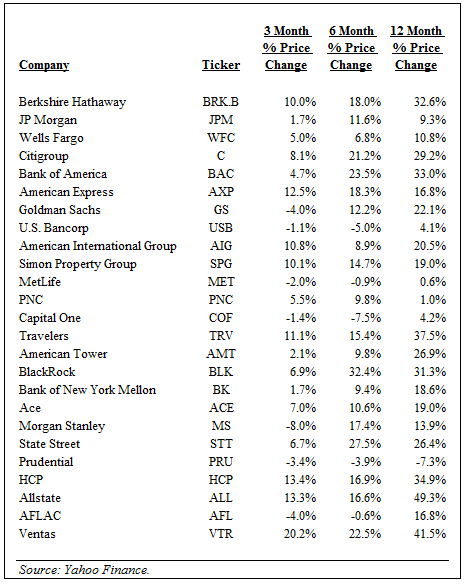

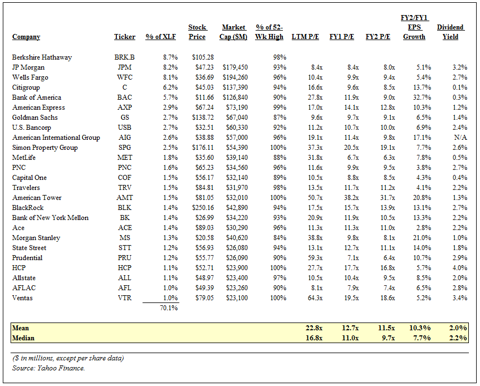

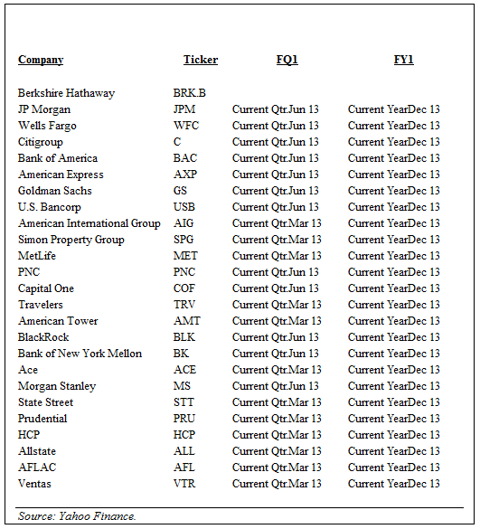

I always prefer to analyze ETFs by looking at their components. The charts below analyze the top 25 companies in the XLF ETF, which represent 70% of the value. There is a lot of data in the charts, so here are a few key takeaways.

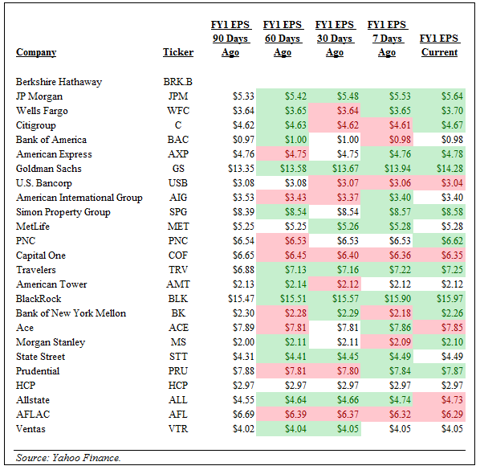

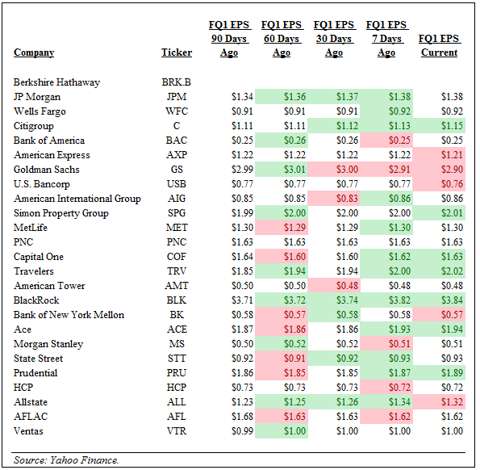

The main reason that I look at forward earnings estimates is to get a sense of analyst sentiment. I do not expect these estimates to be accurate, but I am interested in any changes over time and the implied growth rates and valuation multiples.

Although many of the components of the XLF ETF pulled back from 52-weeks highs over the last few weeks, it seems that analysts are generally raising estimates. I was a bit surprised to see this because Q1 earnings were good, but not great. Expectations for the financial sector have been low, which may account for some of the upward revisions.

Please note that there are many valuation metrics for financial institutions and P/E multiples are not as important for financials as for other companies. Other important metrics like book value and tangible book value are not covered here.

Finally, the dividend yields do not get a lot of attention. Many of the financial institutions are rebuilding their dividends and have lots of room to increase them in the future.

Key Companies In The XLF ETF

I want to highlight the four big banks, which represent 28% of the XLF ETF: JPMorgan (8%), Wells Fargo (WFC) (8%), Citigroup (C) (6%) and Bank of America (BAC) (6%).

Despite their differences, the stock prices of all four are showing a similar pattern. They are all in uptrends going back to mid-2012 and have recently pulled-back to the trendlines.

JPMorgan and Wells Fargo are also near all time highs (prior highs not seen on these timeframes), but Citigroup and Bank of America are far off the pre-crisis highs.

The current levels could be important tests for these banks. I am currently bullish on the sector and own some of these banks (JPMorgan, Citigroup and Bank of America), but my short term perspective may change if the stock prices do not find support around the current levels.

How these banks trade around their multi-month trendlines also has a big impact on the XLF ETF due to the value they represent in the ETF. If the big banks find support at these levels, we could see an end to the pullback and a new leg higher.

It is important to note that these banks already reported Q1 earnings. The results were good, but not great. Their stock prices were little changed on the news, but continued to drift down with the rest of the market. The real test of how investors perceive the Q1 earnings will be if the banks can find support at their trendlines.

(Source: FreeStockCharts.com)

Conclusion

I am bullish on the financial sector, which is represented by the XLF ETF, and especially the big banks. I expect the overall market to exhibit pockets of strength and weakness over the next few months and I am looking for the financials to be one of those pockets of strength. The financials were very attractive last year and experienced sharp rallies from the lows last summer. I don't expect the performance of the financial sector to be as strong going forward, but I do expect the financials to continue to move higher. The financials still have a number of catalysts to look forward to and are trading at low/reasonable valuations. Furthermore, as the banks become more like utilities and carry more capital, the downside risks are reduced. The big banks are now trading at key levels and if they can end their pullbacks here we may see another move higher.

Disclaimer: The opinions expressed above should not be construed as investment advice. This article is not tailored to specific investment objectives. Reliance on this information for the purpose of buying the securities to which this information relates may expose a person to significant risk. The information contained in this article is not intended to make any offer, inducement, invitation or commitment to purchase, subscribe to, provide or sell any securities, service or product or to provide any recommendations on which one should rely for financial, securities, investment or other advice or to take any decision. Readers are encouraged to seek individual advice from their personal, financial, legal and other advisers before making any investment or financial decisions or purchasing any financial, securities or investment related service or product.

Information provided, whether charts or any other statements regarding market, real estate or other financial information, is obtained from sources which we and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Nothing in this article should be interpreted to state or imply that past results are an indication of future performance.

THERE ARE NO WARRANTIES EXPRESSED OR IMPLIED AS TO ACCURACY, TIMELINESS, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION IN THIS ARTICLE OR ANY LINKED WEBSITE.

No comments:

Post a Comment