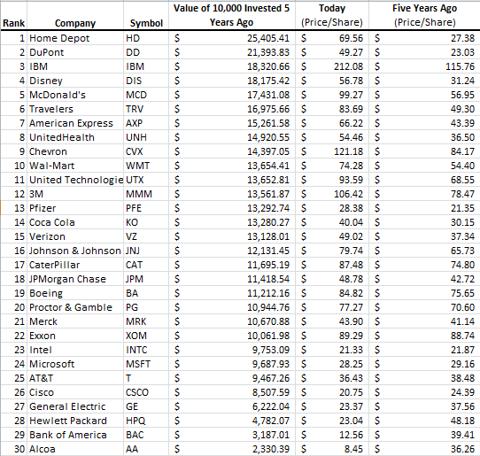

If You Invested $10,000 5 Years Ago ...

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

The Dow 30 is often thought of as a collection of the most stable blue-chip companies in the world. As such, they tend to be the companies most widely invested in by investors who are in it for the long haul.

I am a firm believer in carefully examining a company's past performance, in order to see how they have created value for their shareholders in the past, both in increased share price and increased dividend payouts over time. Particularly, I am interested in how companies have "weathered the storm" during the tough times.

I think we can all agree that the past six years (since late 2007) have been a pretty rough time to be an investor in stocks. In examining the Dow components, I got to thinking how investors who bought and held some of these companies through the tough times made out. So, I back tested all 30 stocks, assuming an investment of $10,000 made exactly five years ago. I also assumed that all dividends were reinvested in additional shares. Some of the results are to be expected, and some were downright surprising. Here are the results, in order, and then some comments on the list:

As you can see, there is a huge difference between the high performers and low performers. One interesting note is that all but the lowest 8 are worth more now than they were in late 2007.

So what do we do now? One thing not to do now is assume that the laggards are "cheap", simply because they are less expensive than they were five years ago. Take Bank of America (BAC) for instance. It isn't cheap, it's diluted. General Electric (GE) had its hands in subprime mortgages, so a lot of the value it had five years ago wasn't real.

However, there are some bargains to be had. Hewlett Packard (HPQ) is in the middle of re-inventing itself. If it can start producing innovative new products the way it used to, HP is a real bargain at these levels. The company has said it plans to turn itself around by 2014. Plus, you get paid a 3.67% dividend in the meantime, just for waiting.

Home Depot (HD), the number one stock on the list, actually benefited from the recession. During the boom years, houses were going up extremely fast, and some were being built at substandard quality to make the building process move quicker. As a result, these houses needed to be repaired and maintained. Not to mention the amount of foreclosed properties sold that needed major work. As the housing market recovers, and banks continue to unload distressed properties, the repairs will continue, and so will Home Depot's profits.

McDonald's (MCD) benefited similar from the recession. Consumers who were used to more expensive dining-out were forced to cut costs and seek less costly alternatives. As a result, to accommodate these new customers, McDonald's has added a whole bunch of healthy options and higher-end foods to its menu. Now with the economy recovering, these customers are still buying. The more "budget-conscious" consumers that McDonald's has catered to for decades also has more disposable income. Add in the fact that McDonald's has been aggressively expanding into emerging markets, and this stock is a buy, despite its gains over the past few years.

My point in this analysis is not that a company's past performance is some kind of guarantee of its future results. What I mean by all of this is that when investing for long term, investors tend to think of how well their stocks "could" perform if everything goes well. You also need to assume that economic conditions won't always be the best, and it is worth something if a company has a history of surviving, or even thriving during the bad times.

No comments:

Post a Comment